A Complete Case Research on Buying Gold: Strategies, Concerns, And Market Insights

Introduction

Gold has been a symbol of wealth and prosperity for centuries, serving not solely as a type of currency but also as a hedge in opposition to inflation and financial uncertainty. In recent times, the allure of gold has surged, prompting many traders, each novice and seasoned, to contemplate it as a viable asset of their portfolios. This case study delves into the intricacies of buying gold, exploring the varied forms of gold investments, market dynamics, and strategic considerations for potential buyers.

Understanding the Kinds of Gold Investments

In the case of buying gold, buyers have a number of choices to select from. Every kind has its personal advantages and considerations:

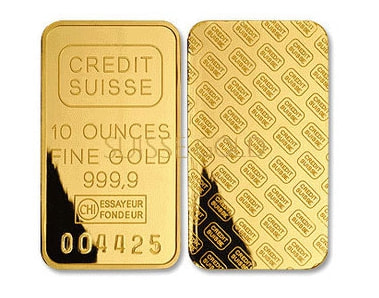

- Bodily Gold: This consists of gold bars, coins, and jewelry. Physical gold is tangible and can be stored securely, however it requires careful dealing with and storage to forestall theft and injury. Traders want to consider purity, weight, and authenticity when purchasing bodily gold.

- Gold ETFs (Alternate-Traded Funds): These funds observe the value of gold and allow investors to buy shares that symbolize a certain quantity of gold. ETFs provide the benefits of liquidity and ease of trading without the need for physical storage.

- Gold Mining Stocks: Investing in companies that mine gold can provide publicity to gold prices while also providing the potential for dividends and capital appreciation. However, this option comes with firm-specific dangers and market volatility.

- Gold Futures and Options: These are monetary contracts that enable investors to speculate on the longer term worth of gold. Whereas they can offer vital returns, they also include high threat and require a deep understanding of market dynamics.

Market Dynamics and Timing

The value of gold is influenced by numerous components, together with financial indicators, geopolitical tensions, and market sentiment. As an illustration, throughout durations of economic downturn, gold often sees increased demand as buyers search protected-haven assets. Conversely, when the financial system is stable, demand might decrease, leading to lower costs.

Case Examine: The 2020 Gold Surge

As an example the dynamics of buying gold, we will study the surge in gold costs during 2020. The onset of the COVID-19 pandemic led to unprecedented economic uncertainty, prompting a worldwide rush to gold as a safe haven. In March 2020, gold costs hit a low of around $1,470 per ounce but surged to over $2,000 per ounce by August 2020.

Investor Strategies

During this period, buyers employed various methods when buying gold:

- Diversification: Many traders chose to diversify their portfolios by allocating a percentage to gold. This method helped mitigate threat whereas capitalizing on gold’s value appreciation.

- Greenback-Value Averaging: Some traders adopted a dollar-value averaging strategy, purchasing gold at regular intervals regardless of worth fluctuations. This technique reduces the impact of volatility and allows traders to accumulate gold over time.

- Research and Evaluation: Savvy investors conducted thorough research on market tendencies, financial indicators, and gold mining corporations earlier than making purchases. This informed resolution-making helped many keep away from potential pitfalls.

Issues for Buying Gold

Whereas buying gold can be a lucrative investment, several issues should be taken into consideration:

- Market Research: Understanding the present market conditions and historical value tendencies is essential. Investors should monitor economic indicators, curiosity charges, and geopolitical events which will impact gold costs.

- Purity and Authenticity: When purchasing physical gold, it’s important to confirm the purity and authenticity of the gold. Investors ought to buy from respected sellers and consider obtaining certificates of authenticity.

- Storage and Safety: Bodily gold requires secure storage. Buyers must decide whether to store gold at dwelling, in a safe deposit field, or through a 3rd-celebration storage facility, every with its personal prices and dangers.

- Prices and Charges: Consumers should remember of any premiums over the spot price, transaction fees, and potential taxes on gold purchases. These prices can considerably impression total returns.

- Long-Term vs. Quick-Time period Funding: Investors want to determine their investment horizon. Gold can be a long-time period hedge against inflation, however brief-time period buying and selling can be risky and requires expertise.

Conclusion

Buying gold generally is a strategic move for investors looking for to diversify their portfolios and protect against economic uncertainty. By understanding the several types of gold investments, market dynamics, and key considerations, buyers could make informed choices that align with their monetary objectives. As demonstrated within the case of the 2020 gold surge, timing and strategy play vital roles in capitalizing on gold’s potential. In the end, thorough analysis and a transparent funding strategy can lead to profitable outcomes within the gold market.

Recommendations

- Keep Informed: Commonly follow market information and evaluation to stay up to date on components influencing gold prices.

- Seek the advice of Consultants: Consider searching for advice from financial advisors or gold investment specialists to tailor methods to individual monetary conditions.

- Diversify Investments: Avoid placing all funds into gold; instead, maintain a diversified portfolio that features varied asset courses to handle risk successfully.

In conclusion, whereas gold is usually a beneficial addition to an funding portfolio, it is crucial to method it with cautious planning and consideration. With the fitting data and technique, investors can harness the potential of gold as a powerful financial asset When you loved this information and you would like to receive more information concerning buy net gold assure visit our own webpage. .